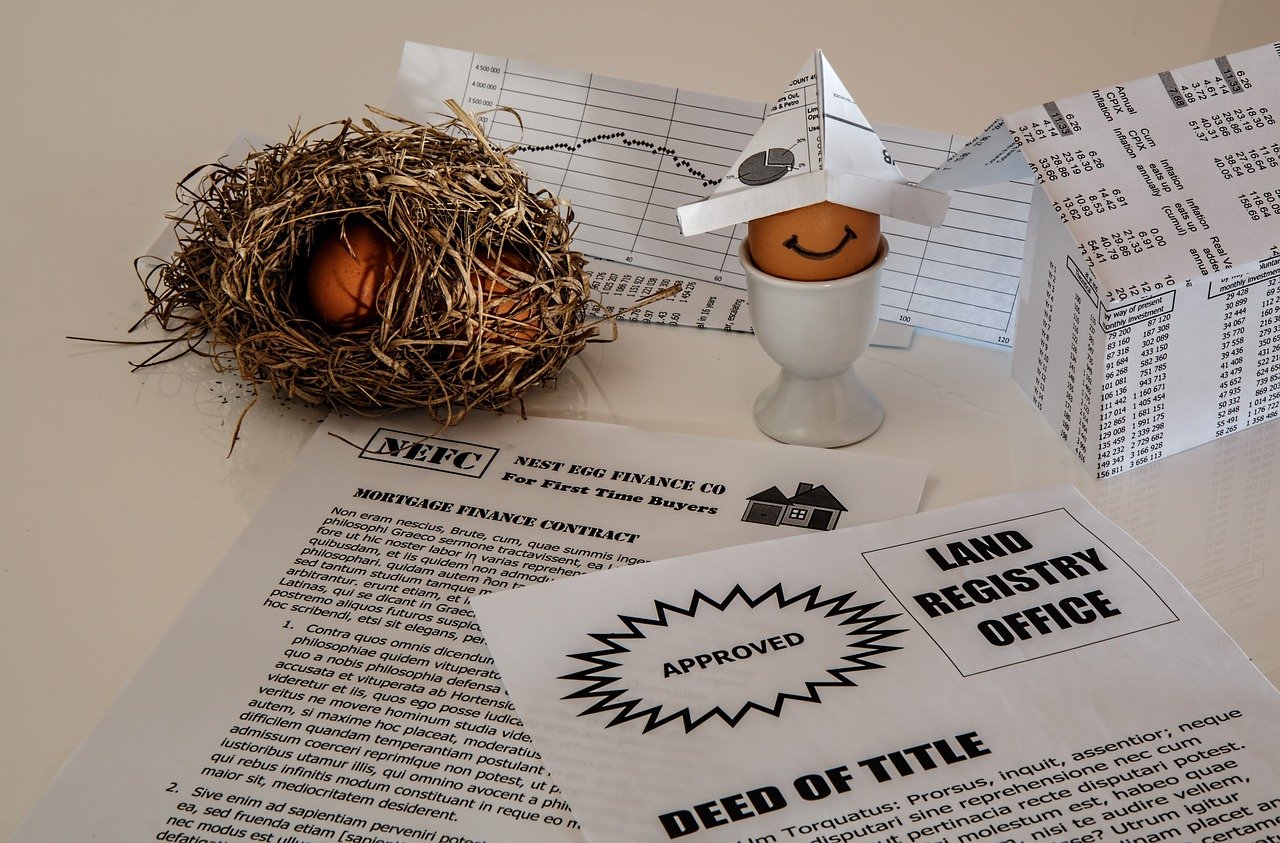

We all face varying degrees of financial challenges that can affect our ability to save and secure a stable future. With mounting pressures such as unexpected expenses or loans from high-interest lenders, it’s tempting to consider using funds from your retirement account for immediate relief. However, before making this decision, we must examine the advantages and disadvantages of borrowing from our nest egg and identify situations where taking out a retirement loan may be an acceptable option.

Understanding Retirement Account Loans: An Overview

Retirement accounts like 401(k)s or Individual Retirement Accounts (IRAs) provide us with the opportunity to save for our golden years, often offering tax benefits and employer matching contributions. While borrowing from these funds is typically discouraged due to potential penalties, withdrawal limits, and impact on future retirements, there are times when a loan may be considered as an acceptable decision.

Four Scenarios Where Borrowing From Retirement Accounts Makes Sense

- Severe Financial Hardship: When faced with life-altering situations such as medical emergencies, natural disasters, or job loss leading to extreme financial distress, tapping into retirement funds may become a necessary course of action. Although it should be the last resort, borrowing from your retirement account could provide immediate relief and help you navigate through these difficult times.

- Cheaper Alternative: If faced with high-interest loans like credit cards or payday advances that would cost more in interest over time than a loan from your retirement account, opting for the latter might make financial sense. However, it’s essential to explore all options first, negotiate lower amounts owed on other debts, and repay the borrowed amount as soon as possible to minimize potential consequences.

- Unavailable Traditional Loans: When you have a less-than-ideal credit score or experience challenges securing traditional loans from banks or financial institutions, retirement fund withdrawals can become an appealing option for addressing pressing needs. However, caution must be exercised in ensuring the borrowed amount is repaid promptly and that this decision does not negatively affect your long-term financial goals.

- Investment Opportunities: Sometimes, taking a calculated risk to invest in significant life-changing opportunities such as launching a business or advancing education can justify borrowing from retirement funds. These endeavors have the potential to create lasting wealth and improved financial security for your future, making them worthy considerations when deciding whether to tap into your nest egg.

Weighing the Pros and Cons of Retirement Account Loans

Before taking out a loan from your retirement account, it’s crucial to carefully evaluate the following factors:

- Secured Retirement Savings: If you have already amassed substantial savings for retirement that will comfortably sustain you in your golden years, exploring alternative funding sources may be more prudent before resorting to touching those funds.

- Job Stability and Satisfaction: Confidence in your job security, as well as enjoyment of your work environment, can make repaying a retirement loan less risky since you have the means and motivation to do so over time.

- Immediate Financial Needs: In cases where urgent funds are required for short-term needs or emergencies, using retirement account loans might be preferable as long as they’re repaid promptly to minimize their impact on your future financial wellbeing.

- Exhausting Other Options: Always explore every other available option before resorting to a loan from your retirement funds, including family assistance, community support programs or negotiating payment plans with creditors.

Conclusion: Making an Informed Decision

Borrowing from your retirement account is not without its consequences and should never be taken lightly. However, by thoroughly understanding the advantages and disadvantages of these loans as well as considering individual circumstances, we can make informed decisions about our financial futures. Remember to exhaust all other funding options before tapping into retirement savings and ensure that any borrowed amount is repaid promptly to minimize negative impacts on your long-term goals. By navigating these challenges with diligence, we can work towards building a secure future while still addressing our immediate financial needs in times of crisis or opportunity.

Disclaimer

While we endeavor to keep information up to date and correct, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability or availability with respect to the website or the information, products, services, or related graphics contained on the website for any purpose. Please note that Bullsevevergreen.com an all its pages and content is intended primarily as an informational platform and not a financial advisor, planner or brokerage firm. The content on our website should not be considered as personalized investment advice for any individual's specific circumstances. Any information provided by us does not constitute professional advice, nor does it take into account your personal financial situation, goals, and needs.

Investing in the market involves risks including potential loss of principal invested. The strategies discussed on our site are based on historical data; past performance is no guarantee of future results. Before making any investment decisions, we encourage you to seek independent professional advice tailored to your financial needs and objectives.

By using Bullsevevergreen.com and its resources, you agree that the information provided does not create a client-broker relationship between us or our affiliates and yourself. We do not provide investment recommendations nor endorse any particular securities, funds, or strategies. Always conduct your due diligence before making investment decisions based on content from Bullsevevergreen.com.