When it comes to retirement, most Americans consider having enough money as the top financial goal. However, there is still room for improvement, especially considering that back in 2011, around 25% of people aged 46-64 reported having no retirement savings at all.

Social Security

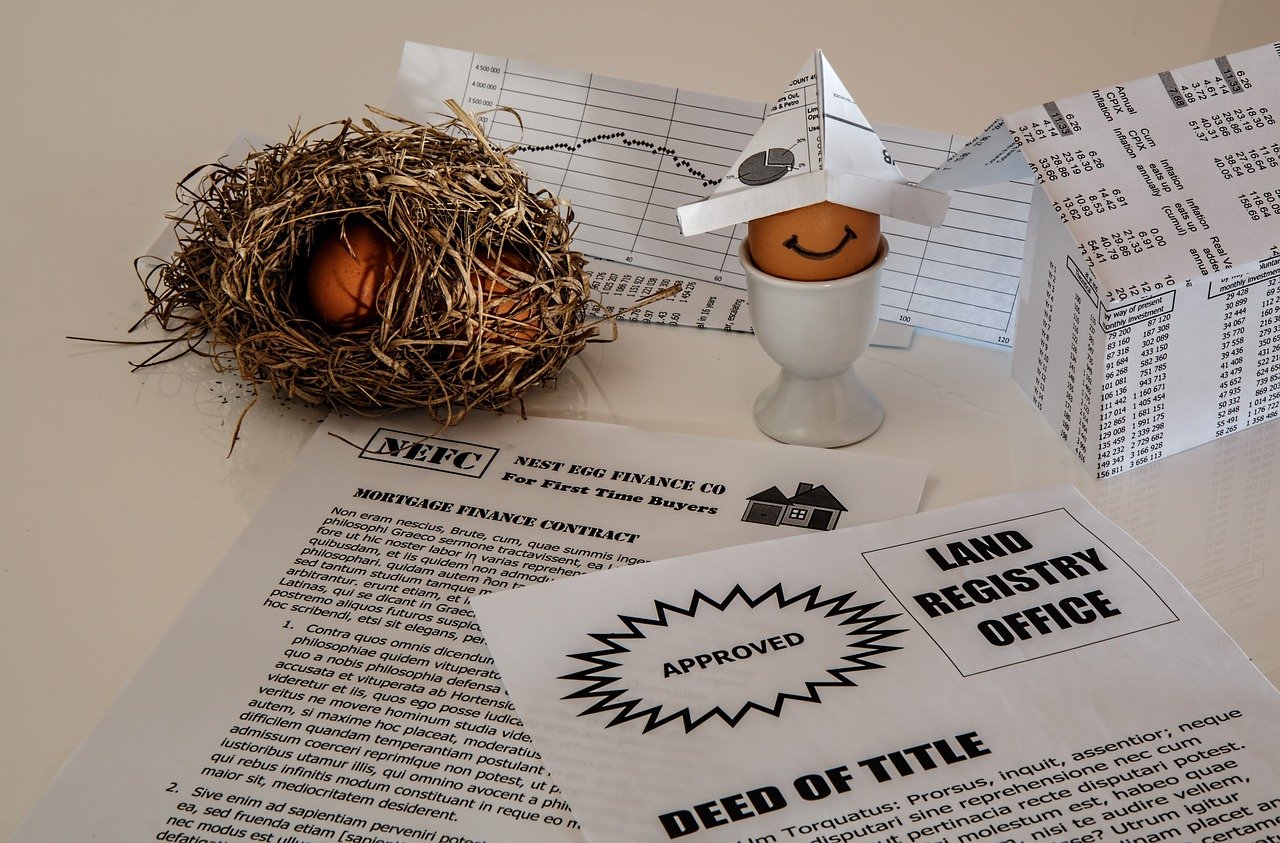

One must realize that relying solely on social security might not be enough to cover the expenses during your golden years. It is therefore vital to create a nest egg that supplements your income. The time to take action and jumpstart your retirement planning is now. This article provides some valuable tips to help you start your retirement fund and maximize the time you have available.

First, regardless of where in life you are, if you don’t already own one, it’s high time that you started a retirement account. To make the right decision on what you need, educate yourself about your retirement account options. Afterward, consult with a financial professional to determine your next steps.

One critical aspect is commitment – both to funding your retirement account and maximizing contributions every year. The IRS sets annual contribution limits, so not meeting these could mean reducing the potential size of your nest egg.

Retirement Account Contributions

Additionally, take advantage of employer-sponsored retirement programs. These can be extremely helpful, as 90% of workers participating in a company program save for retirement, compared to only 20% of those without one. If your employer offers a retirement matching program, use it as it can help you maximize contributions faster.

Keep an eye on your contributions to avoid exceeding the IRS-set annual limit. In 2014, the ceiling for 401(k) contributions was $17,500 ($23,000 for those aged 50 and above). It’s your responsibility, not your employer’s, to ensure you don’t go over this limit. If you do, you will likely face stiff penalties from the IRS.

In 2014, around 58% of workers and 44% of retirees reported having debt issues that could potentially reduce their ability to save for retirement. Therefore, it is vital that at the end of each month, you have money left over for your retirement accounts.

Life’s unpredictability requires preparing for rainy days. Start an emergency fund while balancing debt payment plans and retirement account savings. Although challenging, with some planning (and dedication), this can be achieved.

An often overlooked step in retirement planning is filling out the beneficiary form for your retirement accounts. This is critical if you have a particular allocation plan for your account’s distribution in case of death.

Retiring at 65 may no longer be ideal due to increased life expectancy, which has reached 84 for men and 86 for women. There are physical, social, and mental benefits to remaining in the workforce after age 65. Additionally, there are three main financial benefits of semi-retirement:

- Delayed retirement credits from Social Security if you wait until full retirement age (70), which can maximize your monthly checks later on.

- The option to delay taking withdrawals from 401(k) plans until full retirement age.

- Extra time to reach your retirement goal, particularly helpful if you started late on building a nest egg.

It’s never too early or too late to start building a nest egg, but having a plan increases the chances of maximizing contributions and meeting your retirement goals. Remember that it isn’t over until it’s really over – the time to begin your retirement account is now! What is stopping you from saving for retirement?

Disclaimer

While we endeavor to keep information up to date and correct, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability or availability with respect to the website or the information, products, services, or related graphics contained on the website for any purpose. Please note that Bullsevevergreen.com an all its pages and content is intended primarily as an informational platform and not a financial advisor, planner or brokerage firm. The content on our website should not be considered as personalized investment advice for any individual's specific circumstances. Any information provided by us does not constitute professional advice, nor does it take into account your personal financial situation, goals, and needs.

Investing in the market involves risks including potential loss of principal invested. The strategies discussed on our site are based on historical data; past performance is no guarantee of future results. Before making any investment decisions, we encourage you to seek independent professional advice tailored to your financial needs and objectives.

By using Bullsevevergreen.com and its resources, you agree that the information provided does not create a client-broker relationship between us or our affiliates and yourself. We do not provide investment recommendations nor endorse any particular securities, funds, or strategies. Always conduct your due diligence before making investment decisions based on content from Bullsevevergreen.com.