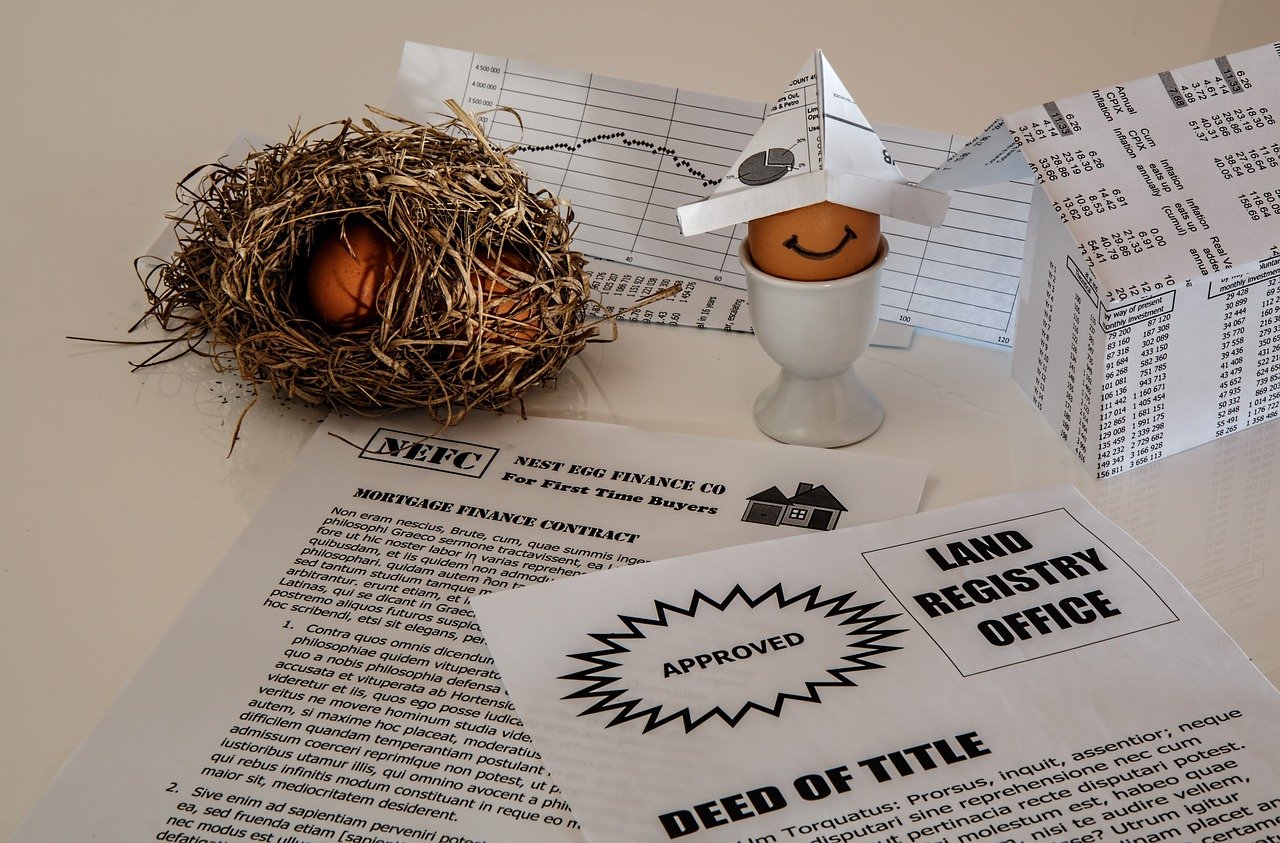

Planning for retirement is crucial, and your nest egg plays an essential role in providing financial security during the later years. While it is ideal to keep the money untouched until you reach retirement age, unforeseen circumstances can force you to consider taking out loans or withdrawals from your retirement account. However, before making such a decision, you need to assess your situation thoroughly and only borrow for valid reasons.

The first step in this process is to determine whether your retirement plan allows loan options. Certain plans, like 401(k), money-purchase pension plans, or profit-sharing plans, let you borrow from them. On the other hand, IRAs and IRA-based plans do not permit such loans. In most cases, you can only withdraw up to half of your vested account balance, with a cap at $50,000.

There are three scenarios where it makes sense to consider borrowing from your retirement account:

Evaluating Your Employment Situation

If your job status is uncertain and you need to repay the loan within five years, borrowing can be a smart move. Failing to do so may result in stiff penalties by the IRS.

Inability to Get Affordable Credit Elsewhere

When your credit score is poor, it becomes challenging to find alternative financing options. Borrowing from your retirement account offers a quicker and less-stringent application process without the need for credit checks. However, you should shop around for favorable terms and include any additional loan costs like origination, administration, and maintenance fees.

Making Home Purchases

Using retirement account loans for down payments on homes can be advantageous. This allows you to put your money to better use than paying rent while also building equity over time. If you need $10,000 or less and have a traditional IRA, the IRS lets you make a penalty-free early withdrawal of up to $10,000 for purchasing your first home (or for your children/grandchildren). However, this is considered taxable income, and you don’t need to repay it.

While these scenarios may seem compelling, remember that tapping into your nest egg can have consequences. It lowers the amount in your retirement account, reducing the potential for compound interest growth over time. Additionally, you could face hefty tax burdens if you cannot pay back the loan or if your employment status changes.

In conclusion, although borrowing from a retirement account may seem attractive in specific situations, it’s critical to weigh all available options before making such a decision. Prudent planning and careful consideration are essential to protect your financial future and ensure the stability of your nest egg.

Disclaimer

While we endeavor to keep information up to date and correct, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability or availability with respect to the website or the information, products, services, or related graphics contained on the website for any purpose. Please note that Bullsevevergreen.com an all its pages and content is intended primarily as an informational platform and not a financial advisor, planner or brokerage firm. The content on our website should not be considered as personalized investment advice for any individual's specific circumstances. Any information provided by us does not constitute professional advice, nor does it take into account your personal financial situation, goals, and needs.

Investing in the market involves risks including potential loss of principal invested. The strategies discussed on our site are based on historical data; past performance is no guarantee of future results. Before making any investment decisions, we encourage you to seek independent professional advice tailored to your financial needs and objectives.

By using Bullsevevergreen.com and its resources, you agree that the information provided does not create a client-broker relationship between us or our affiliates and yourself. We do not provide investment recommendations nor endorse any particular securities, funds, or strategies. Always conduct your due diligence before making investment decisions based on content from Bullsevevergreen.com.